Deductible expenses

el 22 de diciembre, 2022 • 8 min de lectura

Deductible expenses requirements

The first thing you must consider for figuring out if an expense is deductible, is to determine that it is directly related to the economic activity that you carry out, and that it is necessary to carry out such activity.

Any other unrelated expenses will not be deductible.

Every expense must be backed by an invoice (except in a few cases that will be explained below), which should include all your details and the amounts correctly broken down (base amount + VAT and total of the invoice).

Invoice type

Types of expenses

We will explain each expense and how to deduct it according to the existing categories in our software:

Business lunch with clients

The first thing you must consider for deducting this expense is that it must be justified, that is, such expense is claimed because you have had a meeting with your client or supplier. It can be justified by means of an invoice, an email in which you agree to meet in a given place at a given time...

The second thing is that you must ask the establishment for an invoice - or at least a simplified invoice; point out that you need your details on it to correctly deduct this expense.

To deduct both VAT and IRPF, you will need both the full invoice with all your details and a justification of the expense with your income, that is, invoices issued to your customers.

If you only have a simplified invoice, that is, without any of your details, you will also need a bank statement as proof of card-based payment.

If in the expense invoice, don’t appear your personal details, VAT would not be deductible

⛽️Gasoline and vehicle expenses

The first thing you should know about this type of expenses is that they are the most monitored the AEAT (National Agency for Tax Administration). As any other expenses, they must be justified, but vehicle expenses demand more aspects to be considered.

As a rule, and excepting some activities, only VAT is deducted for these expenses at a 50% rate, and yet the conditions for deducting such expenses are:

-

Invoice with all your details.

-

For maintenance expenses, the vehicle cannot be high-end.

-

The vehicle must be registered in your name.

-

Gasoline expenses must take place on working days.

Deduction of vehicle expenses at a 100% rate of both VAT and IRPF

VAT and IRPF on vehicle acquisition and maintenance costs will be deductible provided that the vehicle is used exclusively for carrying out your economic activity.

Keep in mind that, in the event of a Tax Agency inspection, you should always be able to demonstrate that this expenditure is indeed related exclusively to your activity.

How can you prove it?

-

Present a list of your customers and the towns where they reside, visits agreed via email, invoices issued, the technical specifications sheet of your vehicle... Everything that justifies that you use your vehicle for carrying out your activity. Our advice is to keep these supporting documents along with your issued invoices so you can submit them in the event of an inspection.

-

Have the vehicle labelled.

-

The vehicle cannot be high-end.

-

You have a second vehicle for private use.

Even on the basis of all this evidence, the Tax Agency may not admit the deductibility of these expenses.

The activities in which these expenses are 100% deductible are the following:

- Carriage of goods and passengers

- Driving or pilot lessons

- Commercial agents

- Surveillance services

- Test vehicles used by manufacturers

![]() In a nutshell, if these requirements are not met, the law allows a 50% VAT deduction, but not IRPF.

In a nutshell, if these requirements are not met, the law allows a 50% VAT deduction, but not IRPF.

If your activity is VAT exempt, you cannot deduct this type of expenses

📱Computer hardware & tangible assets

These are expenses with a taxable amount greater than EUR 300.00 and a useful life of over one year, so even if the VAT on the acquisition is deducted in the quarter in which it has taken place, IRPF will be written down at the rate set out on the tables released yearly by the Tax Agency, which claim that depending on the type of good that has been acquired, it will be written down throughout a shorter or longer period.

These expenses, like the others, must be invoiced with all your details and must be fully related to your economic activity.

In the case laid down in the image above, the acquisition of the mobile phone is written out, and the direct cost of other products that do not exceed that amount is also included.

If, for example, you buy a computer in spare parts, the overall sum will be considered as a whole, and everything will be written out, even if there are parts which do not exceed the EUR 300.00 base amount.

In case you intend to buy a product on Amazon that will be considered as an investment good based on its prize (+ EUR 300.00 base amount), you must do it through the Amazon ‘My Business’ section to issue the correct invoice.

🛋 Furniture & Other tangible assets

Same conditions apply as in the ‘Computer hardware & tangible assets’ section above.

A percentage of IRPF is deducted according to the tables released by the Tax Agency.

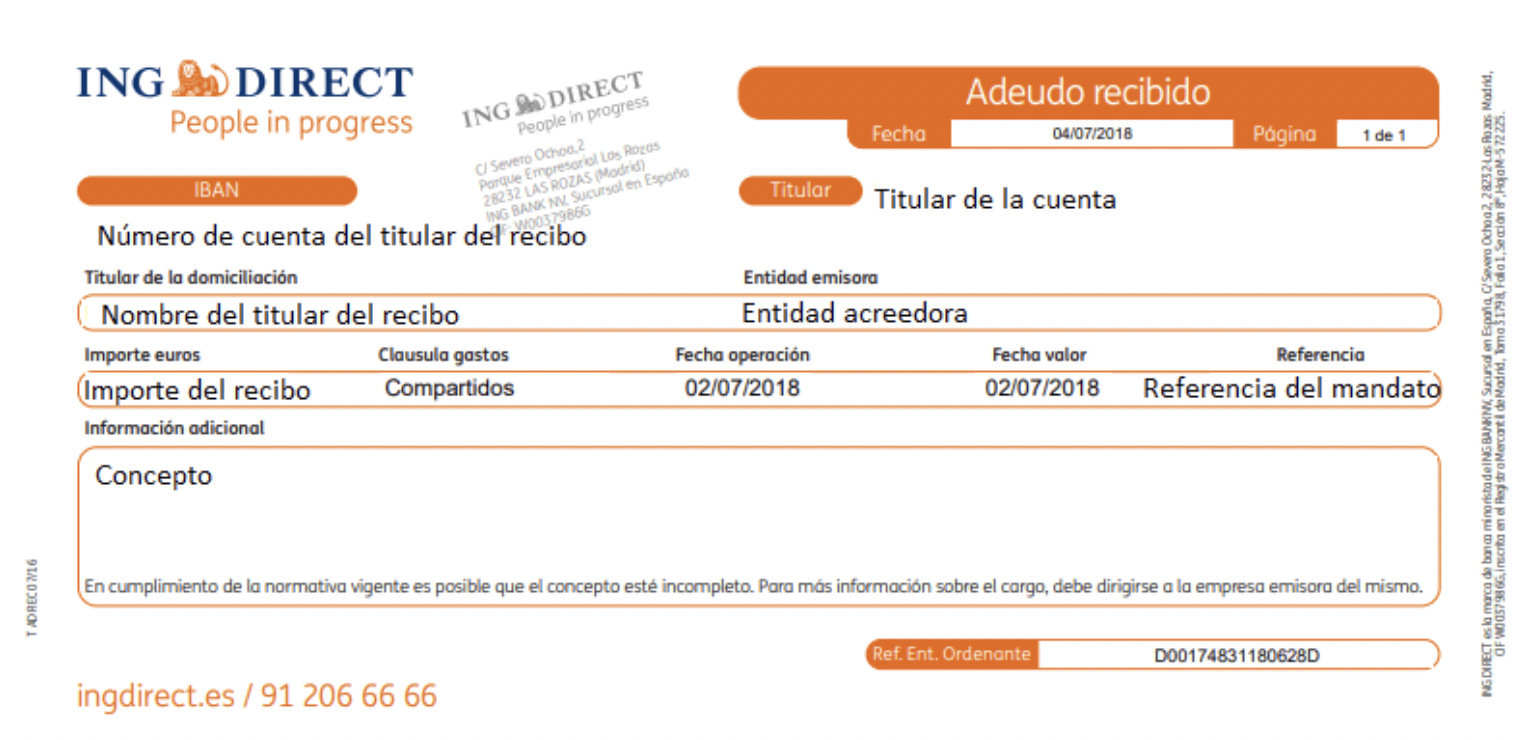

🤧 Health insurance

This is one of the expenses for which it is not possible to provide an invoice. It can be deducted by submitting a bank statement with the transaction details.

Remember that, in any of the cases explained below, the policy must be registered in your name.

However, there is a ceiling to this expense. It is limited to EUR 500.00 per year if you are the only insured, plus EUR 500.00 per household member (spouse and/or child under 25) whose annual income is not higher than the annual minimum wage. This limit rises to EUR 1,500.00 if the household member has a disability.

If you have health insurance with copayments, these will not be deductible.

Apart from health insurance and civil liability insurance, the rest of the insurances are not deductible in your economic activity.

💡Home office utility bills

Electricity, gas, phone and internet bills are not 100% deductible, but you can deduct 30% of the percentage of the cost allocated to your activity specified in your self-employed registration form 036 (“modelo 036”) and they are only deductible in IRPF, not in VAT (IVA).

Requirement to deduct this type of expenses: they must always be in your name, as well as the rental contract or mortgage of the property from which you carry out your activity.

Let’s see an example:

I have an internet bill amounting to 20.00 + VAT = EUR 24.20

In my form 036, I have reported that 10% of my internet expenses correspond to my activity, so we can deduct the following:

20.00 x 10% = 2.00 * 30% = EUR 0.60 deductible base and EUR 0.13 non deductible VAT.

📞 Telephone bills

- Telephone and internet bills that are part of the television package, are NOT deductible.

- A mobile line that you use exclusively for your activity and it appears in a separate line of the invoice, it will be 100% deductible, as it does not count as a utility bill. This requires that every expense is broken down line by line in the invoice, so that it is possible to determine which parts are deductible as utility bills, not deductible, or 100% deductible - in the case of a professional phone line.

🏠 Rent (house/flat)

The deduction of rent expense is a controversial case, as sometimes you can deduct it and sometimes you can't. At Xolo, we treat each case individually: the first thing we do is to review the contract to see if there is any clause in it that specifically indicates that we can or cannot carry out an economic activity in the dwelling.

In the case of being able to deduct it, this housing will have to be indicated in the model 036, in the same way as the rest of the utilities, and it will be deducted in the same way (30% of the percentage affected).

💰Professional expenses

This category covers all the expenses related to your activity that do not meet a specific deductibility standard, unlike utility bills or gasoline.

As in other cases, you should always have an invoice in your name for these expenses and they must be fully related to your activity.

Examples of professional expenses: management costs, services provided by other professionals, purchase of materials for carrying out the activity...

-

If you have received an invoice related to services provided by other professionals which includes a withholding tax (“retención”), bear in mind that the latter must be submitted and settled quarterly in form 111 and included in the annual transaction summary in form 190.

-

For invoices related to rental of premises where the activity is carried out, the withholding tax applied is submitted and settled quarterly in form 115 and included in the annual transaction summary in form 180.

-

In this section, Amazon invoices should also be mentioned, since as a rule, they are not valid because of deficiencies in the invoice and identification details of the real seller. Therefore, it is necessary to enter and place the orders through the Amazon ‘My Business’ section so that the invoices include the DNI/NIF.

When doing this, if the issuer of the invoice is not Amazon Spain, you must ask the seller to issue an invoice, otherwise only IRPF will be deducted on this expense.

🧾 Social security & Professional fee

This expense is not backed by an invoice, so you must provide the bank statement of the transaction. When it comes to a professional body fee, it must pertain to the economic activity you carry out.

🚅 Transportation & accommodation

These are expenses incurred when travelling to our client’s workplace and must always be justified by invoices or the emails in which such trip was agreed.

Let’s see what happens with each transport:

-

Flights: the ticket itself is not valid as proof of expense. You must ask the airline for an invoice, except for Ryanair, as it does not issue invoices, so the ticket containing your details is valid as proof of expense for IRPF deduction.

-

Long distance trains: invoice is always necessary, as the ticket is not deductible.

-

Travel pass: it is not deductible as its use exclusively to carry out the economic activity cannot be proven.

-

Public transport: if there is no full invoice (which is difficult to get), only IRPF will be deductible for these expenses.

-

Taxi and the like: full invoice is always necessary for both VAT and IRPF on this expense to be deducted, so we encourage you to always ask for a full invoice and to have justification and proof of payment for these expenses.

-

Parking and tolls: For parking rental, paid parking or tolls, only IRPF is deductible, according to Article 95 of the Spanish VAT Law, unless you provide a full invoice with all you details.

To deduct both VAT and IRPF, you will need both the full invoice with all your details and a justification of the expense with your income, that is, invoices issued to your customers.

If you only have a simplified invoice, that is, without any of your details, you will also need a bank statement as proof of card-based payment.

|

TRANSPORTATION & ACCOMMODATION |

|

|

Flights (except Ryanair) |

Company invoice with full details |

|

Ryanair flights |

Ticket (only for IRPF) and justification of expenditure with income |

|

Train tickets |

Full invoice |

|

Travel pass |

Non deductible, as its use exclusively for the activity cannot be proven |

|

Public transport |

If there is no full invoice, only for IRPF and proof of expenditure |

|

Taxi |

If there is no full invoice, only for IRPF and proof of expenditure |

|

Uber and other apps |

If there is no full invoice, only for IRPF. Request full invoice to the issuer through the app to deduct VAT and IRPF. |

|

Parking and tolls |

For parking expenses, paid parking or tolls, only IRPF is deductible, according to Article 95 of the Spanish VAT Law unless you provide a full invoice with all your details. |

🍜 Food & drinks

Several conditions need to be met to claim these expenses:

-

There is a daily ceiling of EUR 26.67 for costs incurred in Spain and EUR 48.08 abroad.

-

In case of overnight stay at the destination, this ceiling rises to EUR 53.34 in Spain and EUR 91.35 abroad.

-

Expenses must always take place in catering and hospitality establishments. Supermarket or delivery service bills are not accepted.

-

An invoice with your details is required to claim this expense.

-

Pay only by electronic means and always keep proof of payment.

-

These expenses require justification, as for transport and accommodation.

-

Costs must be incurred during working hours allocated to the activity.

To deduct both VAT and IRPF, you will need both the full invoice with all your details and a justification of the expense with your income, that is, invoices issued to your customers.

If only have a simplified invoice, that is, without any of your details, you will also need a bank statement certifying the card-based payment transaction.

🙋♂️Personal/non-deductible

If you have uploaded to the platform an expense claim, but you are unsure about its deductibility, put it in this category and leave us a comment so that we can determine if this expense can be included in your accounts.

Nevertheless, before incurring an expense, especially if it involves a large sum, we recommend that you ask us to assess the case.

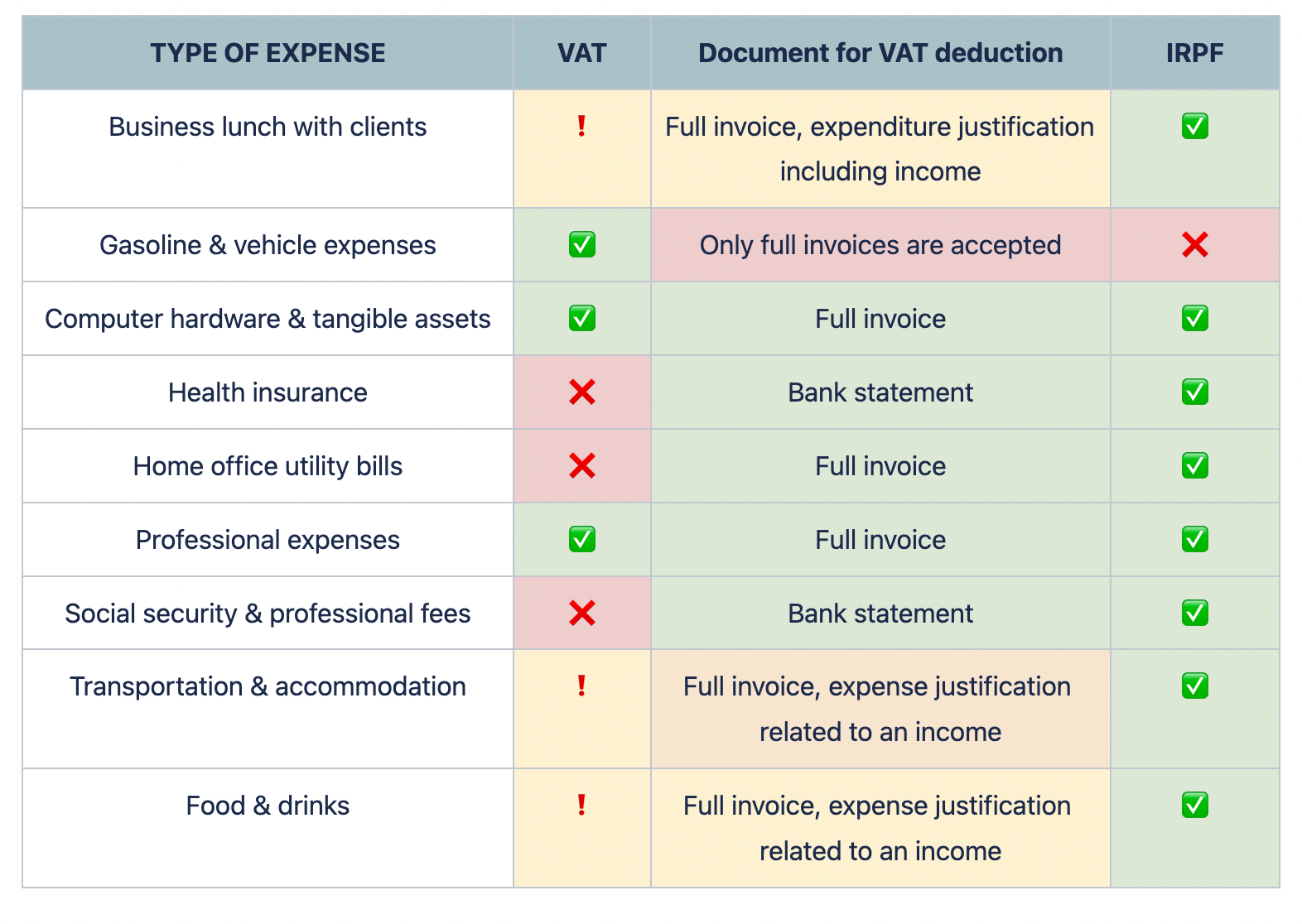

Summary Table